Welcome to the Care.fi Resource Centre!

Simplifying Supply Chain Financing for Hospitals

We have a great product called CareCred that we hope will transform the healthcare sector. Much like any other great product, we need a team to take this idea forward.

Interested?

Great! Let’s dive into what CareCred does.

Here at Care.fi, we aim to help healthcare providers and patients alike. To make you understand how we do this, we’re going to break down what ‘supply chain financing’ entails, and how our team steps in to ease the bottlenecks.

Simplifying Supply Chain Management for Hospitals:

Broadly, supply chain management is the handling of the entire production process of a good or service — all the way from its point of origin to its final destination.

But what about the cost that gets incurred in performing all these involved processes??

This is where Supply Chain Financing comes into play, which is a set of tech-based financing processes that aims at lowering costs and improving the overall efficiency for the various parties involved in such transactions.

But when it comes to the healthcare sector, things are not as straightforward.

Alright, let’s simplify that further by setting the scene:

FeelWell Hospital is expanding its operations and requires financial assistance. Initially, banks can provide loans to help with the costs of FeelWell’s infrastructure and fancy technical equipment. However, FeelWell will also require financing for its Operating Expenses.

OpEx is what the hospital incurs daily to keep things running smoothly. For example, OpEx would include the payroll for FeelWell staff, Consultations of doctors and perhaps most importantly — pharmaceuticals and consumables. Unfortunately, this bill often runs into crores of rupees, and hospitals often can’t be financed by conventional lenders as the process tends to be tedious.

So can there be a solution??

Let’s try to imagine another scenario

Let’s say Med-Suppliers thinks this over and after multiple rounds of talks, decides to supply the goods to FeelWell on credit on one condition: that the payment for these goods must be made within 30 days of their delivery. With some bargaining, FeelWell agrees to pay back this amount within 60 days.

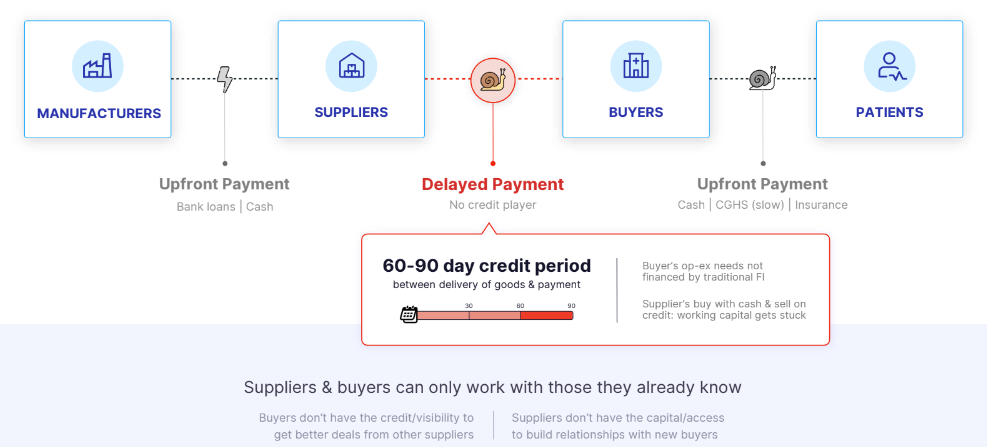

Med-Suppliers approaches the Manufacturers. The Manufacturer is unhappy with the idea of making goods on credit and insists that the Med-Suppliers pay them with cash at that very moment. Med-Suppliers makes the payment upfront and continues to wait anxiously for FeelWell to reimburse them.

This ‘delayed’ payment from FeelWell to the Med-Suppliers hampers the overall purchasing process. Moreover, it affects any future business equations for everyone involved…

Can you spot the two root causes of the conundrum in this scenario?

- FeelWell’s Op-Ex requirements are not financed by traditional financial lenders such as banks

- Med-Supplier’s selling on credit and buying with cash leads to a significant strain on the available working capital.

And that’s where we come in.

We have devised a simple and innovative cash flow-based lending platform that takes care of both the Supplier and the Hospital’s credit needs. With the use of CareCred, Med-Suppliers sells the required goods to FeelWell Hospital and raises an invoice on the platform. After which, the money is disbursed to Med-Suppliers upfront so there is simpler liquidity, and Med-Suppliers can approach the Manufacturers without any trouble.

Another use case of the product would allow us to partner with hospitals such as FeelWell, to pay Med-Suppliers on their behalf. Once the credit period has lapsed, FeelWell would return the money, and everyone’s happy!

With CareCred, we are certain that our offerings will have a meaningful impact on both providers and patients. By collaborating with us, we promise our users a more seamless workflow to spend more time focusing on what truly matters — the lives of the patient.

PS: To know more about how are we building Care.fi, feel free to visit this tweet on Twitter: Building Care.fi